Introduction

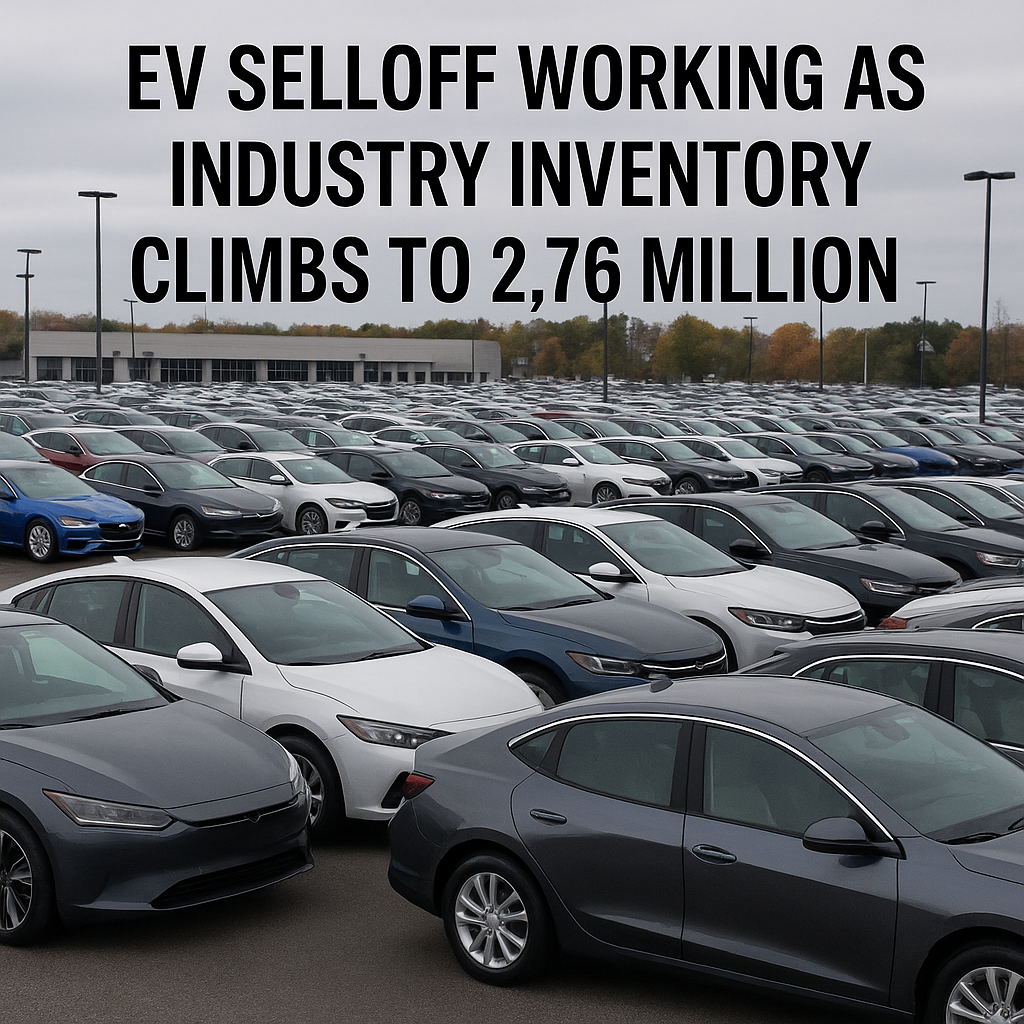

The EV selloff has been working across the automotive sector as industry inventory has climbed to a staggering 2.76 million vehicles in 2025. This shift has been observed as automakers continue to produce electric models at record speed, yet consumer demand has not aligned in the same way. The imbalance has forced dealerships, automakers, and policymakers to rethink strategies to stabilize both sales and pricing.

Why the EV Selloff is Happening

The reasons behind this selloff are not limited to just pricing or technology adoption. Multiple interconnected factors have been observed:

- Consumer hesitation due to high upfront prices and range anxiety.

- Slower adoption in rural areas, where charging networks remain limited.

- Increased competition leading to oversupply of similar models.

Key Specifications of Current Inventory

- Total U.S. auto inventory: 2.76 million units

- EV share of inventory: 7.4% (approx. 204,000 EVs)

- Average EV days on lot: 108 days (compared to 73 days for gas vehicles)

- Price cuts: Tesla and Ford offering discounts up to 10%

Top Features Driving and Limiting EV Demand

While features such as fast acceleration, silent performance, and sustainability are positives, limitations still slow growth:

- Positive Features: Fast charging technology, longer ranges, zero tailpipe emissions.

- Limiting Factors: Limited charging infrastructure, software glitches, and higher interest rates.

Pricing Pressures and Consumer Trends

Price wars among automakers have been observed as the inventory backlog grows. Tesla, Ford, Hyundai, and GM have all reduced prices to stimulate demand. However, consumer preferences remain divided between affordable hybrids and fully electric vehicles.

Automaker Responses and Incentives

Automakers are increasingly offering incentives such as:

- Federal and state tax credits

- Free charging station installations

- Extended warranties

These incentives have been observed as necessary tools to clear excess EV stock while building consumer confidence.

Technology, Design, and Sustainability Factors

EV design continues to evolve with aerodynamic styling, AI-based infotainment, and advanced safety systems. Sustainability goals have been integrated by using recycled materials and eco-friendly manufacturing processes. Yet, without strong consumer adoption, even the most sustainable designs struggle to reach the road.

Impact on U.S. Auto Market

The EV selloff has been working as a double-edged sword. On one side, consumers benefit from competitive pricing, but on the other, automakers face shrinking profit margins. Analysts predict that if inventories remain high, a second wave of aggressive discounting will reshape the U.S. auto market in 2026.

Internal and External Industry Connectivity

The EV ecosystem depends heavily on charging networks, battery supply chains, and dealer incentives. Without synchronized growth across these areas, inventories are likely to remain high.

Here’s the chart:

EV Inventory vs. Gas Vehicle Inventory (2025)

- EVs: 204,000 units

- Gas Vehicles: 2,556,000 units

FAQs

Q1: Why is EV inventory rising in the U.S.?

Inventory is rising because production is outpacing demand, while high prices and infrastructure gaps slow consumer adoption.

Q2: How does the EV selloff affect consumers?

Consumers may benefit from lower prices and better incentives, though resale values may decline in the near term.

Q3: Will automakers cut production in 2026?

Analysts predict a potential slowdown in production to balance inventory with consumer demand.

Q4: Which automakers are most affected?

Tesla, Ford, Hyundai, and GM are among the most impacted due to their aggressive EV expansion.

Image Optimization (Rich Media)

Image File Name: ev-selloff-inventory-2025.jpg

Alt Text: EV selloff as industry inventory climbs to 2.76 million

Title: EV selloff working as industry inventory climbs to 2.76 million

Caption: U.S. auto industry faces an EV selloff as inventories rise to record highs in 2025.

Description: An image showing dealership lots filled with unsold EVs, representing the U.S. EV selloff as inventory climbs to 2.76 million units.

Conclusion

The EV selloff working as industry inventory climbs to 2.76 million has been viewed as a warning sign for the U.S. auto sector. Although consumers may enjoy lower prices and generous incentives, automakers face pressure to recalibrate production and strategies. Unless demand catches up with supply, the industry could be forced into a cycle of discounts and restructuring, reshaping the electric vehicle landscape in the coming years.