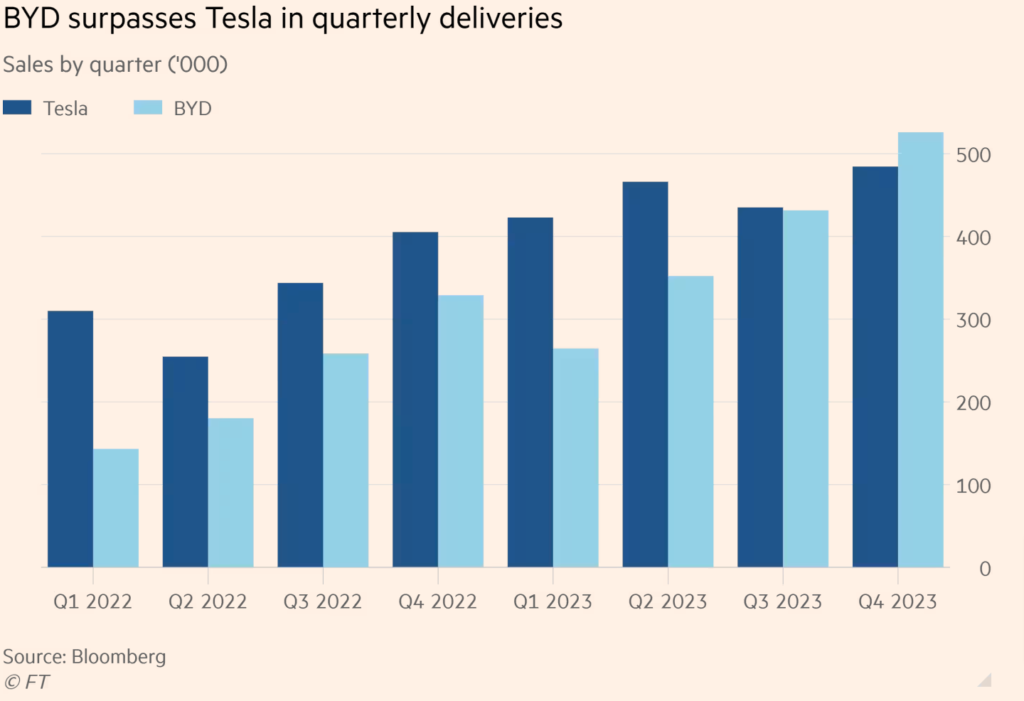

In the latest quarter, Elon Musk’s Tesla exceeded analysts’ expectations but relinquished its position as the leading electric vehicle manufacturer worldwide for the first time.

Chinese rival BYD surpassed Tesla’s fourth-quarter deliveries, achieving record sales of 526,000 battery-only vehicles compared to Tesla’s 484,000. This shift in leadership highlights BYD’s ascent, a once lesser-known Chinese company that Musk had previously downplayed.

While Tesla’s growth has predominantly been in its home market, BYD is expanding its presence globally, notably in Europe where its electric cars are gaining visibility due to competitive pricing. Danni Hewson, head of financial analysis at AJ Bell, noted that BYD’s success underscores the challenges faced by traditional automakers worldwide in adapting to evolving consumer preferences for more affordable and intelligent electric vehicles.

BYD, based in Shenzhen, declared itself the “world champion” for “new energy vehicles” with total annual sales exceeding 3 million in 2023, including plug-in hybrid cars. In contrast, Tesla’s annual sales for the same year were 1.81 million vehicles, with BYD delivering 1.58 million fully electric cars. Analysts suggest that BYD’s success is partly attributed to Tesla’s market share pursuit, which led to price cuts, making Chinese models more appealing.

Tu Le, founder of Sino Auto Insights, emphasized the strength of BYD and China’s growing influence in the global electric vehicle market. While both companies reduced car prices in the past year, Tesla’s cuts were more dramatic, indicating the potential for BYD to further distance itself from the U.S. automaker in the coming year.

Despite the competition, Tesla aims to demonstrate strong deliveries and momentum in 2024, with an annual sales figure of 1.8 million vehicles in 2023 being considered a significant achievement in a challenging macroeconomic environment for the electric vehicle sector, according to Wedbush Securities analyst Dan Ives.

Please utilize the sharing tools accessible through the share button located at the top or side of articles. Replicating articles for distribution is a violation of FT.com Terms and Conditions and Copyright Policy. For the acquisition of additional rights, please contact [email protected]. Subscribers have the option to share up to 10 or 20 articles per month using the gift article service. Further details can be found at https://www.ft.com/tour.

For more information, you can visit the article at https://www.ft.com/content/716c9b0b-d8cd-491a-a91b-d70c1e540797.

After years of state support and strategic industrial planning from Beijing, Chinese automakers now capitalize on their country’s control over the production of nearly every resource, material, and component essential for manufacturing electric vehicles.

BYD’s vertically integrated structure, where it oversees mines and manufactures batteries and chips, has garnered admiration from foreign competitors amidst the global automotive industry’s shift away from the combustion engine.

According to Automobility, a Shanghai-based consultancy, six of the top-selling electric vehicle models in China, the world’s largest car market, were BYD cars at the end of last year. BYD’s market share has expanded to over 35%, while Tesla has faced challenges in keeping pace with the product launches by its Chinese counterparts, as noted by the consultancy.